VAT Refund

What is VAT Refund?

All the registered business are required to file a VAT return furnishing the details of sales, purchases output VAT and input VAT paid during the tax period. Here, the output VAT is the amount which is collected on sales and Input VAT is the amount which is paid to the supplier towards purchases / expenses. The eligible input VAT amount will be allowed to be adjusted with the output VAT amount. After adjusting the output VAT and Input VAT, the result will lead to one of the following situations.

VAT Payable: If output VAT amount is higher than the Input VAT, the balance will be VAT payable which needs to be paid to FTA.

VAT Refundable: If output VAT is lesser than the input VAT amount, the excess balance will be VAT refundable.

How to Treat VAT Refundable as per UAE VAT?

The taxpayer has following two options in treating the excess input VAT commonly known as VAT refundable:

- 1. The taxpayer will be eligible to request for a VAT refund

- 2. If he does not wish to request for a refund of the excess input VAT, the excess recoverable tax will be carried forward to subsequent tax periods and can be used to offset against the payable tax and / or penalties, or he can apply for a refund later at any point in time

How to Claim VAT Refund?

If you have excess input VAT, an option will be available on the VAT Return to request a refund.

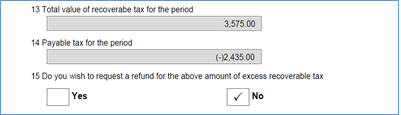

As shown in the image above, you need to select ‘Yes’ in box no. 15 ‘Do you wish to request a refund for the above amount of excess recoverable tax’. If you select ‘No’, your excess recoverable tax will be carried forward to subsequent Tax Periods and can be used to offset against payable tax and / or penalties.

After the VAT Return is submitted, you are required to complete the VAT refund application ‘Form VAT311’. The following are the steps to submit VAT refund form ‘VAT311’:

-

- 1.Login to FTA e-Services Portal using your username and password

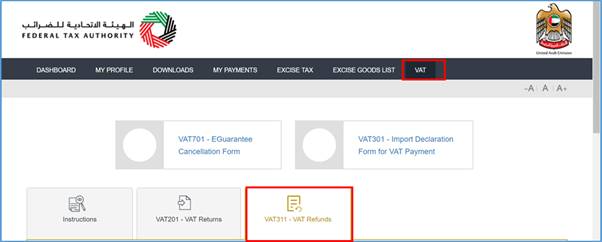

- 2.In order to access the refund form, navigate to the ‘VAT’ tab and then to the ‘VAT Refunds’ tab

-

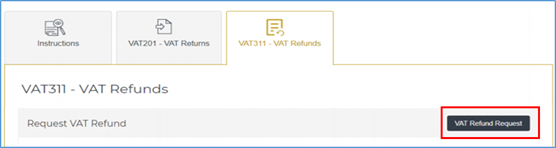

- 3.Click ‘VAT Refund Request’ as shown in the image below:

-

- 4.On clicking ‘VAT Refund Request’, the refund form will open. Fill the details in all the applicable fields. Mandatory fields are mandatorily to be completed in order to submit the Refund Form. Most of the details are auto-populated. The following are the fields available in the VAT refund form 311:

- a.TRN, Legal name of entity (English) etc.: This section is auto-populated on the basis of the information contained in your account user profile. It is therefore very important that the information contained in your profile is both correct and accurate. Please check it before completing the refund form

- b.Total amount of Excess Refundable Tax (AED) : This field is auto-populated based on the excess refundable tax reported in the last VAT returns less administration penalties due (except for the late registration penalty which is shown separately)

- c.The amount you wish to have refunded (AED): Please enter the amount you wish to have refunded here. This amount must be equal to or less than the ‘Total amount of Excess Refundable Tax’

- d.Remaining amount of eligible Excess Refundable Tax: This field is auto-populated and represents the remaining amount of excess refundable tax which you may apply for a refund in the future.

- e. Late registration penalty amount (in AED) : This field is auto-populated depending on whether you have a penalty imposed and have settled the late registration penalty for VAT or not. The following table gives the details when the amount will be shown in this field:

- 4.On clicking ‘VAT Refund Request’, the refund form will open. Fill the details in all the applicable fields. Mandatory fields are mandatorily to be completed in order to submit the Refund Form. Most of the details are auto-populated. The following are the fields available in the VAT refund form 311:

| Scenarios | Amount |

| IF you have not been charged a penalty | Zero |

| If you have been charged a penalty and you have paid the penalty | Zero |

| If you have been charged penalty but are yet to be paid the penalty at the time of claiming this refund | 20,000 |

-

-

- f.Authorized Signatory and Declaration: Authorized signatory will be auto-populated and you need to tick the declaration before submitting

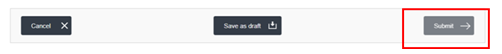

- 5.Once you complete the form, click on the ‘Submit’ button as shown below:

-

The refund form will be processed within 20 business days of submission. You will receive an email notification from the FTA on the result of your application. Once your claim is approved, the amount will be refunded within 5 business days. You will receive a confirmation email of the refund and you may check your balance in ‘My Payment’ tab -> Transaction History section displaying the amount refunded.