What is the Corporate Tax rate?

Corporate Tax will be levied at a headline rate of 9% on Taxable Income exceeding AED 375,000. Taxable Income below this threshold will be subject to a 0% rate of Corporate Tax.

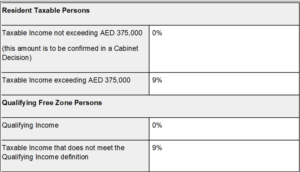

Corporate Tax will be charged on Taxable Income as follows:

What is the Withholding Tax rate?

A 0% withholding tax may apply to certain types of UAE sourced income paid to non-residents. Because of the 0% rate, in practice, no withholding tax would be due and there will be no withholding tax related registration and filing obligations for UAE businesses or foreign recipients of UAE sourced income.

Withholding tax does not apply to transactions between UAE resident persons.